Home Page - Profile - Financial Highlights

| EUR millions and as % | 2024 | 2023 | 2022 |

| Revenue | 84,683 | 86,153 | 79,184 |

| Gross margin | 56,765 | 59,277 | 54,196 |

| Gross margin as a percentage of revenue | 67,0% | 68,8% | 68,4% |

| Profit from recurring operations | 19,565 | 22,796 | 21,050 |

| Current operating margin as a percentage of revenue | 23,1% | 26,5% | 26,6% |

| Net profit | 12,908 | 15,921 | 14,702 |

| Net profit, minority interests’ share | 7,700 | 9,617 | 8,905 |

| Net profit, Group share | 5,208 | 6,304 | 5,797 |

| Cash from operations before changes in working capital | 27,212 | 29,511 | 26,765 |

| Operating investments | 5,531 | 7,478 | 4,969 |

| Operating free cash flow (a) | 10,473 | 8,101 | 10,110 |

| Equity, Group share | 24,294 | 21,527 | 19,038 |

| Minority interests | 42,558 | 38,766 | 35,276 |

| Total equity | 66,852 | 60,293 | 54,314 |

| Net financial debt (b) | 9,058 | 10,548 | 8,867 |

| Net financial debt / Total equity ratio | 13,5% | 17,5% | 16,3% |

(a) See the consolidated cash flow statement in the consolidated financial statements for definition of operating free cash flow.

(b) Excluding “Lease liabilities” and “Purchase commitments for minority interests’ shares”, which are recognized as either “Other current liabilities” or “Other non-current liabilities”, depending on the specific case.

| in euros | 2024 | 2023 | 2022 |

| Earnings per share | |||

| Basic Group share of net profit per share | 28.87 | 34.94 | 32.13 |

| Diluted Group share of net profit per share | 28.86 | 34.93 | 32.11 |

| Dividend per share | |||

| Interim dividend | 5.50 | 5.50 | 5.00 |

| Final dividend | 7.50 | 7.50 | 7.50 |

| Gross amount paid for the fiscal year (a) | 13.00 | 13.00 | 12.00 |

(a) Excluding the impact of tax regulations applicable to recipients.

| 2024 | 2023 | 2024/2023 Change | ||

| EUR millions and as % | published | organic (a) | ||

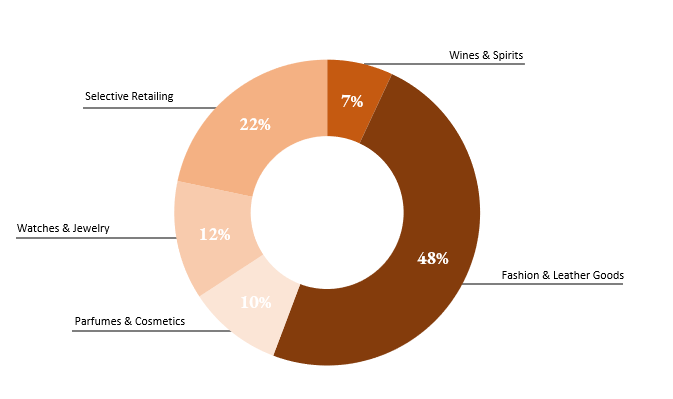

| Wines & Spirits | 5,862 | 6,602 | -11% | -8% |

| Fashion and Leather Goods | 41,060 | 42,169 | -3% | -1% |

| Perfumes and Cosmetics | 8,418 | 8,271 | 2% | 4% |

| Watches and Jewelry | 10,577 | 10,902 | -3% | -2% |

| Selective Retailing | 18,262 | 17,885 | 2% | 6% |

| Other activities and eliminations | 504 | 324 | ns | ns |

| TOTAL | 84,863 | 86,153 | -2% | 1% |

(a) On a constant consolidation scope and currency basis. For the Group, the impact of changes in scope with respect to 2023 was -1% and the impact of exchange rate fluctuations was -2%.

| EUR millions and as % | 2024 | 2023 | 2024/2023 change |

| Wines & Spirits | 1,356 | 2,109 | -36% |

| Fashion and Leather Goods | 15,230 | 16,836 | -10% |

| Perfumes and Cosmetics | 671 | 713 | -6% |

| Watches and Jewelry | 1,546 | 2,162 | -28% |

| Selective Retailing | 1,385 | 1,391 | 0% |

| Other activities and eliminations | -623 | -415 | - |

| TOTAL | 19,565 | 22,796 | -14% |